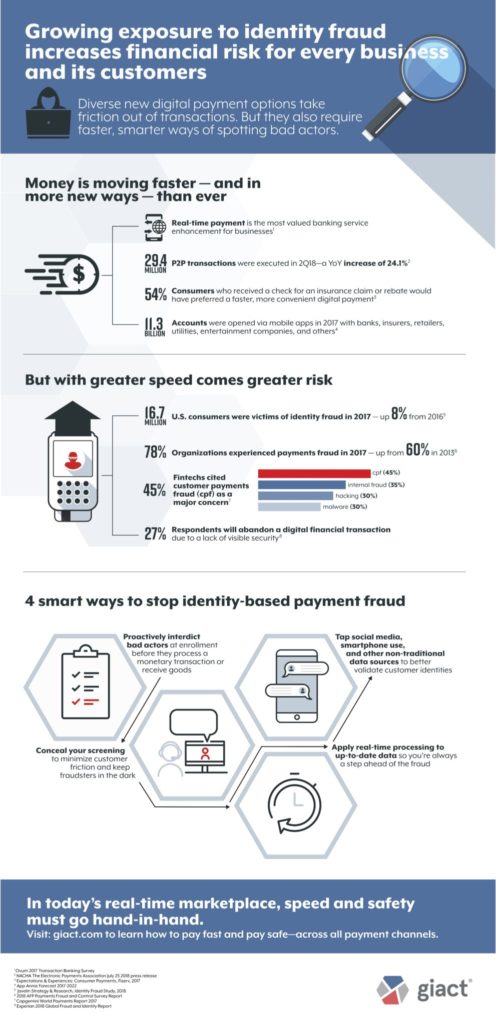

DALLAS, TX – GIACT Systems, the leader in helping companies positively identify and authenticate customer, today announced the publication of new infographic, Growing Exposure to Identity Fraud Increases Financial Risk for Every Business and its Customers. The infographic highlights identity fraud trends impacting peer-to-peer (P2P) and mobile payment channels.

Watch the on-demand webinar on new account fraud here.

In 2017, over 16.7 million U.S. consumers fell victim to identity fraud, up 8% from the year prior, putting FIs, P2P payment processors and their customers at serious risk1. Given the amount of personally identifiable information (PII) available, fraudulent actors are migrating to popular, more convenient and faster payment channels. P2P, with its over 29.4 million transactions in Q2 2018 alone, up 24.1% from the year prior, is at particular risk2.

Preventing Identity-based payment fraud

“P2P and mobile channels makeup the ideal breeding ground for fraud, given the increasing volume of transactions taking place and that the technology is relatively new,” said David Barnhardt, EVP of Product at GIACT. “At GIACT, we believe that good fraud protection begins at enrollment and continues, on an ongoing basis, throughout the customer and payment lifecycle.”

In addition to highlighting the latest fraud trends impacting P2P and mobile transactions, the infographic details best practices for preventing identity-based payment fraud. Best practices urge FIs and P2P processors to proactively interdict bad actors; conceal your screening; tap into social media, smartphone use and other non-traditional data source; and well as apply real-time processing to up-to-date data.

“Whenever banks introduce a new payment method, fraudsters immediately go on the attack. P2P payments in particular is an incredibly attractive avenue for ripping off consumers and banks are rightfully concerned,” said Al Pascual, SVP of Research and Head of Fraud & Security at Javelin Strategy & Research.