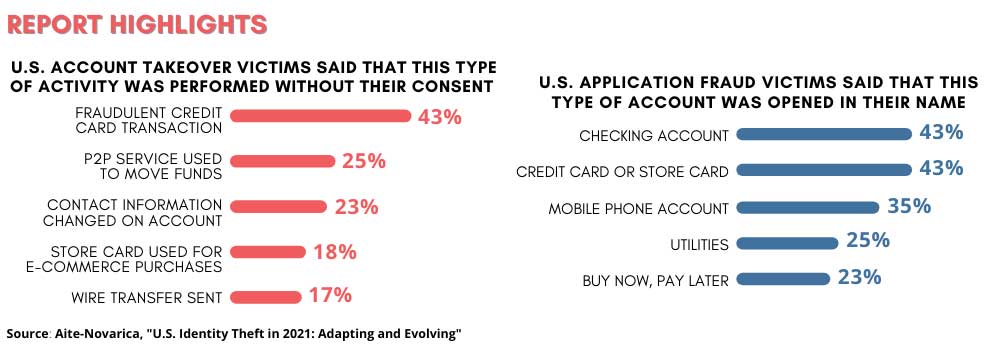

Announced today, GIACT (a Refinitiv company) released its annual report, developed by Aite-Novarica, on identity theft in 2021. According to the report, 25% of U.S. consumers were impacted by identity theft in 2021. The report’s findings show sustained high levels of identity theft – including application fraud and account takeover – that have victimized consumers along with virtually every type of financial product, commercial platform and government support.

The report also found that payment channels including peer-to-peer (P2P) and buy now, pay later (BNPL) have also increasingly come under attack. While application fraud and account takeover (ATO) continue to mainly target credit cards, the second most common channel for ATO was P2P (experienced by 25% of ATO victims) and the fifth most common channel for application fraud was BNPL (experienced by 23% of application fraud victims).

Consumers Growing Intolerant of Fraud

The report also tracked a decline in the tolerance that consumers have for financial institutions that allow identity theft to occur. For example, the report found that 41% of consumer loan application fraud victims and 27% of credit card application fraud victims said that they were unlikely or extremely unlikely to do business with the financial institution that allowed the fraud to take place – up from 20% and 14%, respectively, in 2020. Meanwhile, 31% of ATO victims claimed that they moved their account to another financial institution in 2021 as a result of ATO.

Topics Covered

- Identity fraud’s shift back to consumer financial products from government stimulus and COVID-related scams;

- Identity theft’s impact by age group, including a sharp increase in the number of victims ages 55 and older;

- Identity theft trends impacting buy now, pay later (BNPL), P2P, checking and credit accounts, healthcare, utilities and more;

- Consumer sentiment and the growing dissatisfaction that consumers have for organizations that allow fraud to occur;

- Recommendations for addressing identity theft.