DALLAS – March 6, 2019 – GIACT Systems®, the leader in helping companies positively identify and authenticate customers, today announced the release of the Javelin 2019 Identity Fraud Study, sponsored in part by GIACT. The study, independently produced by Javelin Strategy & Research, highlights trends around identity fraud, including research that found that new account fraud (NAF) losses increased by $400 million in 2018 to total $3.4 billion.

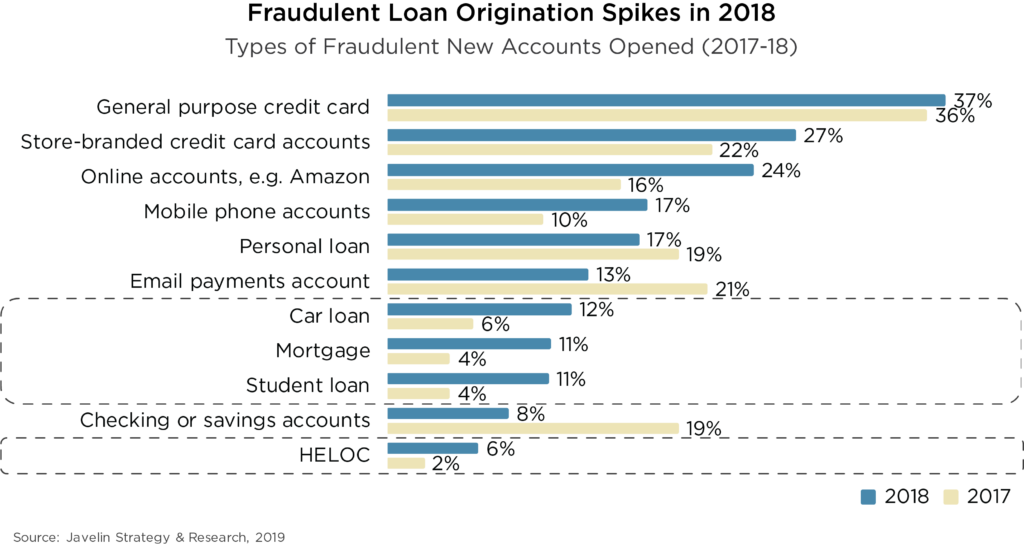

The growth in New Account Fraud sits in contrast to the decline of overall fraud which dropped 15% from 2017 to 2018. The type of fraudulent new accounts that displayed notable growth were focused on loan origination and included general purpose and store-branded credit cards, online accounts (such as eBay and Amazon), mobile phone accounts, car loans, mortgages, home equity lines of credit (HELOC) and student loans.

GIACT and Javelin will be co-hosting a webinar entitled, “The Rise of New Account Fraud: Best Practices in Identification and Verification” that explores the growing threat of new account fraud and the emergence of unconventional fraud targets experiencing especially high incidences of fraud.

Click here to register for the webinar

With stronger protections for existing accounts, particularly with traditional banking products like card, fraudsters are migrating to new accounts and unconventional account targets, FIs, lenders, mobile carriers, and other organizations looking to better secure their enrollment process will need to enhance how they capture, validate and monitor customer identities.

Al Pascual, Senior Vice President, Research Director and Head of Fraud & Security at Javelin Strategy & Research

“With the amount of data available on the dark web, it’s imperative that FIs apply more data and better analytics into their ongoing identity management programs,” said David Barnhardt, EVP of Product at GIACT. “This is made possible by better understanding a customer’s digital DNA – that is, the multiple traditional and non-traditional data points that make up someone’s identity footprint.”

via PRNewswire